Leading Candlestick Patterns for Trading Stocks

Explore how to interpret candlestick signals, detect dark pool activity, and identify reliable stock buy signals using advanced technical analysis techniques.

In this short video lesson, you’ll explore how Relational Technical Analysis works in practice and start learning how to recognize the best candlestick patterns for trading stocks.

How to read candlestick charts and interpret chart structure

How to recognize dark pool activity and institutional accumulation in stock charts

Entry & exit stock buy signals derived from leading candlestick patterns

These techniques apply not just to stocks but also to ETFs, options, crypto, and more — wherever chart-reading and pattern recognition matter.

Identifying Strong Buy Signals via Candlestick Patterns

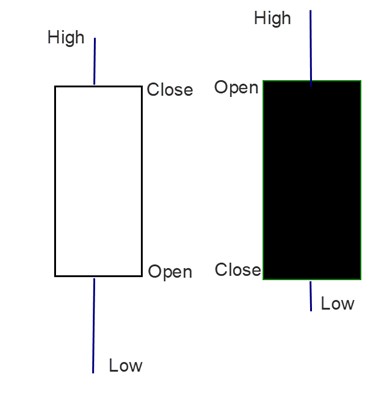

Candlestick charts are by far one of the most powerful ways to read stock charts. Each candle conveys whether price closed above or below its open, plus the wicks and tails show the intraday high and low prices. Understanding these basics is the foundation for spotting reliable candlestick patterns for trading stocks.

powerful ways to read stock charts. Each candle conveys whether price closed above or below its open, plus the wicks and tails show the intraday high and low prices. Understanding these basics is the foundation for spotting reliable candlestick patterns for trading stocks.

But that’s just the start. We go deeper — teaching you how to watch dark pool activity in stock charts. These hidden trades are often made by large institutions, and they can leave footprints in the price action that show up in candlesticks. Recognizing these zones of accumulation or distribution helps you confirm stock buy signals with greater confidence.

In this mini course, we’ll show you our relational technical analysis tools and shortcuts are used to distinguish between weak signals and strong ones.

With TechniTrader, you learn how to filter noise, manage risk, and execute trades backed by chart evidence — not guesswork.

Mini Course Highlights & Key Topics

Beyond Continuation & Reversal

Quiz 1

Buying and Selling Stocks: The Most Reliable Candlestick Patterns

Quiz 2

Reliable Entry Signals with Candlesticks

Quiz 3

Candlesticks First, THEN Indicators

Quiz 4

Check these out next...

We've been teaching for more than 25 years, so even introductory stuff is mind-blowing!